Elevate Your Banking Experience with Us

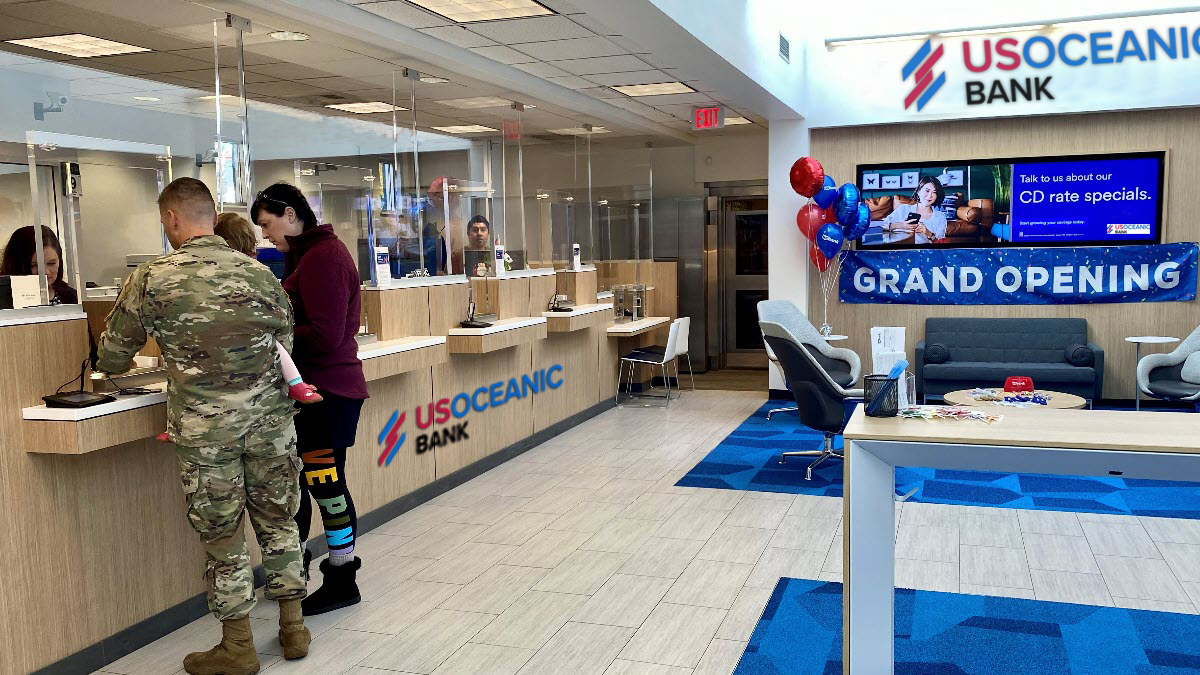

Welcome to a new era of banking at Usoceanic, where traditional barriers dissolve, and boundless opportunities emerge.

Find a checking solution that fits your needs. No monthly maintenance fees, No minimum balance requirements, Federally insured by the NCUA up to $250,000. The perfect checking account for your everyday needs.

Introducing the Usoceanic Saver Account, featuring a competitive 4.1% AER interest rate. From money-saving tips to seamless online Savings Account applications, we offer guidance on maximizing your funds.

Get a limitless 2% CASH BACK on all purchases, every single day, no matter where you shop. Plus, snag a $200 cash bonus (equivalent to 20,000 points) when you spend $1,000 within your first 3 billing cycles.

Empowering Financial Freedom and Seamless Transactions

Credit cards offer flexibility and rewards but come with the responsibility of managing borrowed funds and potential interest. Debit cards provide immediate access to your own money without the need to repay or pay interest. Choosing the right card type depends on your financial goals, spending habits, and comfort level with borrowing.

Get paid up to 2 days early when you open a MyLife Checking Account!

MyLife Checking is the go-to account for your everyday needs.

Your checking account should adapt to you, not the other way around. That’s why with MyLife Checking you can use your Visa® debit card at checkout, pair it with your mobile wallet for contactless payments, and keep track of your finances on the go with USOCEANI’s digital banking. However you bank or shop, you can rely on MyLife Checking.

- No Maintenance Fees or Minimum Balance Requirements

- Get Paid Early with Direct Deposit

- Access 30,000+ No-Fee ATMs, Get Refunded for Outside ATM

Choose the card that’s right for you. 13.99%APR*

Visa Classic Credit Card. No teaser rates here. Our Classic Card offers an everyday low interest rate. Save 35% on the interest you pay compared to the national average credit card interest rates!1 Plus, you won't pay any annual fees or penalty APRs.

- No annual fees, no penalty APRs.

- Pay with your mobile device using Apple Pay®, Samsung Pay®, Google Pay™

- Free supplementary cards – great for your spouse or child.

- Cash advances and balance transfers at low fees.

Welcome to GLOBAL360ROI, your premier Bitcoin mining platform designed to maximize profits and unlock the full potential of your investment.

MINING BITCOIN HAS NEVER BEEN EASIER

GLOBAL360ROI is an advanced Bitcoin mining platform designed to help you maximize your profits with state-of-the-art mining technology, efficient operations, and an easy-to-use interface. Whether you're a beginner or an experienced miner, we offer a seamless and secure experience to grow your crypto investments.

- Sign up now and receive $100 free to kickstart

- Enjoy easy and fast daily withdrawals for seamless access to your earnings!

- Get 24/7 customer support, always ready to assist you whenever you need help!

WATCH YOUR MONEY GROW, SECURELY.

We prioritize the security of your funds and personal data by using advanced encryption, cutting-edge protection protocols, and continuous system monitoring. Our platform is designed with multiple layers of security to ensure your investments are always protected, giving you peace of mind while you grow your assets.

- Top Security for Your Funds: Advanced encryption and security protocols keep your investments safe 24/7.

- Top Security for Your Funds: Advanced encryption and security protocols keep your investments safe 24/7.

- Safe, Reliable, and Trusted: Enjoy peace of mind!

15

M

Satisfied Customers

7450

+

Experts Team Members

10

M

Credit & Debit Cards Approved

1780

+

Nationwide Branches

Your Financial Goals, Our Purpose: Explore Our Solutions.

Discover a checking solution tailored to your requirements. With no monthly maintenance fees and no minimum balance requirements, you can manage your finances hassle-free. Plus, rest assured funds.

LEARN MOREIntroducing the Usoceanic Saver Account, featuring a competitive 4.1% AER interest rate. From money-saving tips to seamless online Savings Account applications, we offer guidance on maximizing your funds.

LEARN MOREGet a limitless 2% CASH BACK on all purchases, every single day, no matter where you shop. Plus, snag a $200 cash bonus (equivalent to 20,000 points) when you spend $1,000 within your first 3 billing cycles.

LEARN MOREAt USOCEANIC BANK, we understand that purchasing a home is not just a financial transaction; it’s a significant milestone in your life. It’s about finding your sanctuary, building equity for your future.

LEARN MOREAt USOCEANIC BANK, we understand the pivotal role that access to capital plays in the success and growth of businesses. Whether you’re a small startup or a large enterprise, having the right financing in place.

LEARN MOREWe understand that life is full of unexpected expenses and financial challenges. Whether it’s covering medical bills, consolidating debt, making home improvements, or funding a special occasion, having reliable financing.

LEARN MOREUnlocking Boundless Opportunities: Simplifying International Loans with Usoceanic Bank

In today's interconnected world, access to financial resources across borders is crucial for businesses, individuals, and organizations alike. At our institution, we've taken strides to streamline the process of obtaining international loans, making it easier and more efficient than ever before.At our institution, we're committed to making international loans more accessible, transparent, and efficient for borrowers around the globe. Whether you're a multinational corporation, small business owner, or individual investor, we're here to help you navigate the complexities of international finance and unlock new opportunities for growth and success.

Oblast Mining in Ukraine secures a $450 million loan approval

We take immense pride in bolstering businesses worldwide with our international loans. At the heart of our mission is the unwavering commitment to support small businesses, empowering them to thrive and succeed in today's global landscape. Your success fuels our pride.

Bessie Cooper

Director of International LoansAn Individual Retirement Account (IRA)

An individual retirement account, or IRA, is a personal retirement savings account.

Even if you've signed up for an employer-sponsored plan like a 401(k), 403(b) or TSP, you can still open an IRA to boost your savings and add flexibility to your budget. Investments you can make inside an IRA include:

- Stocks and options

- Mutual funds and exchange-traded funds, or ETFs

- Bonds and CDs

USOCEANIC is committed to supporting you every step of the way towards your retirement goals.

At USOCEANIC, we firmly believe that saving for retirement is paramount. We offer a range of tools, educational resources, and support to guide you along the journey, ensuring you can retire on your own terms.

- $0 Minimum Deposit

- 24/7 Professional Guidance

- Satisfaction GuaranteedSee note

Choose Us for a Future-Ready Banking Experience

24/7 Accessibility

Unlike traditional banks with limited operating hours, digital banking offers round-the-clock access.

User-Friendly Interfaces

Digital banking platforms typically feature intuitive and user-friendly interfaces.

Cost Savings

Digital banks often have lower operational costs than brick-and-mortar banks, allowing.

Speedy Transactions

Digital banking processes transactions faster than traditional methods, making it ideal for urgent.

Join Us in Embracing the Future of Digital Banking Revolution

Our user-friendly digital platform allows you to open an account from the comfort of your home or on the go, anytime, anywhere.

Empowering Financial Freedom and Seamless Transactions

Credit cards offer flexibility and rewards but come with the responsibility of managing borrowed funds and potential interest. Debit cards provide immediate access to your own money without the need to repay or pay interest. Choosing the right card type depends on your financial goals, spending habits, and comfort level with borrowing.